2023 Venture Capital Predictions: What to Invest in?

What trends do you invest in as a VC and focus on as a founder?

The end of the year is — usually — a time for resolutions.

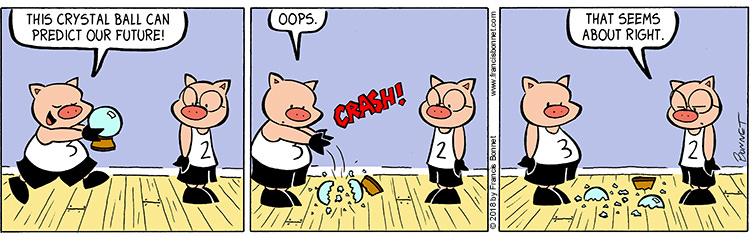

But not in the VC world! For VCs, it's time for predictions (so intriguing!) 🔮

What will this new year hold for us?

What trends do you invest in as VCs and focus on as founders?

Could we possibly back out from making our own predictions?

Let's take a look at what are the main industry predictions for the new year, and try to guess a few.

Generative AI is here to stay

Generative AI will continue to be the keyword for investments in 2023.

In short, for those who were not looking: the term refers to artificial intelligence capable of creating content. This technology has recently been applied to various practical use cases such as image creation, natural conversation, code writing, and many other areas.

What will be the most interesting applications of this technology?

Productivity

”AI will drive 10-100x performance improvements, showing companies that there is a new way to work — advancing from “text to image” to more complex workflows, such as “text to SQL queries” or, eventually, “text to excel modeling” and more.”

This is a quote from Sarah Wang, GP at a16z (from here), but this is a prediction that almost all VCs agree with: AI will be massively applied to productivity tools and will make our work much faster/simpler (only in some specific areas, obviously).

George Mathew, Managing Director of Insight Partners, also believes that more and more startups will incorporate AI into their software to enhance the way we work.

Tomasz Tunguz goes so far as to say that AI will be an indispensable feature for SaaS workflows.Enterprise

"Will see a new generation of enterprise applications emerge to challenge established vendors in almost all software categories.”

This is a quote from Villi Iltchev, Partner at Two Sigma Ventures, but, as above, it is an extremely popular opinion, and not really a prediction, since we are already seeing several startups doing just that.Videogames

“By the end of 2023, it’ll be possible to use a text prompt to generate virtually any asset needed to produce a game.”

James Gwertzman, Partner at a16z (who runs a vertical fund on gaming), predicts that by the end of 2023, AI will have reached the development necessary to be able to generate all the bits of creativity needed to create a video game (graphics, music, storyboards...). If you want to learn more, I recommend reading the article The Generative AI Revolution in Games, written by Gwertzman.

Rob Toews is more skeptical and wonders how many VCs will still be investing in AI from 2024 onward 👇

[🔮Our prediction🔮]

In our opinion, many (if not everyone): AI will simply become an indispensable aspect of any software, as the Cloud is today. It will no longer even be mentioned as a feature, probably, it will be just taken for granted (again: like the cloud today - can you imagine in 2023 in founder saying, "and our software is also available in the cloud!").

Sustainability and Climate Tech

This is not a new topic or a new technology, but there is certainly a new (sharper) awareness.

Newer generations, more attentive and interested in the topic, are starting to be part of VC firms and startup teams, increasingly giving the industry a steer towards the sector.

What are the most significant insights for 2023?

Catalyzer for VC funds

According to Abe Yokell, Managing Partner at Congruent Ventures, climate tech investments will emerge as a "safe haven" for entrepreneurs and investors. The inevitable impacts of climate change, coupled with the recent passage of the Inflation Reduction Act, will create the conditions for a long run-up in the climate tech landscape.

More than just cars

Trucks, planes, and boats will begin to be electric (or at least become hybrids). Better batteries, more efficient electric motors, and hybrid technologies will increase the range also for vehicles larger than cars — thinks Ian Roundtree, GP at Cantos Ventures.

Nuclear fission

Also, Ian Rountree argues that VCs will begin to invest seriously in fission starting in 2023: “it will dawn on more investors that fission has been relatively under-invested — and may well be our best shot at decarbonizing the grid fast enough to matter”

Software

More and more then, climate change will be fought through software, in parallel with traditional deeptech hardware solutions, according to Mar Hershenson, Managing Partner at Pear VC

Other industries

Fintech

GGV predicts that in 2023, fintech companies will aim to become their customers' true financial operating systems (OS). This means providing a variety of financial services within the same platform, to serve users' needs across the boardConsumer

A major new social app will make its way through the debris of Twitter and Facebook. The time is ripe for a consumer app that will supplant TikTok, Snap (and even BeReal?) — predicts Ann Bordetsky, Partner at NEAFuture of Work

The transition between remote work, office-based work, and "hybrid" (half-and-half) work is a sensitive issue that touches everyone closely. Even though it is still in the making, there is no established standard or one solution that is going mainstream compared to the others, and the tools to support these new models are only a few and not definitive — which means that in 2023 the opportunities to innovate will be immense. Carlotta Siniscalco, Partner at Emergence, wrote a very insightful and really interesting piece that we recommend reading if you are interested in the topic: The Hybrid Work Pyramid of Needs.

For us, the one thing that is clear is: in the next 24 months, the future of work could be pretty competitive, and those seed-stage companies that will decide to stay in person, same office, will have a competitive advantage over other models. That said, remote and hybrid organizations still need to find a platform to keep people on the same page and engaged.Cybersecurity

According to Casey Aylward, Partner at Accel, cybersecurity will continue to be a good investment in 2023: the economic slowdown and the shift to remote working have incentivized more companies to change their work tools in favor of more modern solutions, mainly on the cloud. This change increases the need for security as data and communications are primarily stored online.

Investments will change pace and shape

2023 will have a different pace from previous years in particular:

Investments will have a new shape: investors' FOMO will drop, deals will decrease and return to a more humane pace, and due diligence will lengthen and deepen ("Fundraises will no longer feel like shotgun weddings and instead will return to mutual dating exercises," says Frank Rotman), valuations will drop - on this almost everyone agrees

On the other hand, we count on making decisions in a few days. That is always a competitive advantage in the seed stage. And not just that. We want to be much more aggressive in the pre-seed stage as well.

The most "raisable" round will (again) be the Seed round, according to this poll by Maren Bannon. This is quite physiological, however, and given the structure of the rounds themselves: in the Seed phase, there is no longer the high risk of the Pre-Seed, and the more concrete requirements proper to a Series A round are not yet required.

Not only that: the Seed valuations will also be the ones to remain highest because everyone sees Seed as the lowest risk round — predicts Mar Hershenson, Managing Partner at Pear VC.

Our observation of this specific market segment highlights quite a different behavior in Q4 2022. Those that keep valuations high at this stage have a high risk of not raising the round or taking months to close. So, be careful!There will be many down rounds or flat rounds (subsequent rounds lowering or maintaining the previous valuation) that will increase from 5% of the total to 30%, predicts Tomasz Tunguz.

P.S. We started seeing those in Q3 2022.Startups will focus more on building a solid foundation for their business. Discipline and solidity will be more important than speed at any cost, predicts Frank Rotman, Founding Partner at QED Investors.

A new generation of founders and ideas

According to Sophia Bendz, GP at Cherry Ventures, the conditions going into 2023 will lead to the creation of a generation of more determined, resilient, and strategic founders, having had to deal with this environment and these difficulties.

Ideas will also be different: in a time of economic crisis, tighter budgets are forcing individuals to be more creative, to solve only the problems that people are really willing to pay for, and to be more frugal, spending only on things that have a significant impact on their business — predicts Mar Hershenson, Managing Partner at Pear VC

What About Lombardstreet Ventures Predictions for 2023?

To make any prediction about what future we have in front of us, it's essential to summarize what the past couple of years have been for the high-tech economy in general and startup land in particular.

Public and private markets have been so busy investing, growing, and spending like crazy that nobody heard the music stop abruptly.

TL;DR: 2021 has been the most fantastic party ever

Three hundred sixty-five days of non-stop fun with video conferencing companies valued more than the major seven airline companies altogether, founders raising quickly at crazy valuations like $30M, $70M, and even $100M in their first round.

People not just raised billions of dollars but could even spend them all without any supervision. Isn't that cool?

Of course, someone had to pay, and many people got burned. But then again, what a party!

2022: we had lunch with leftovers for six months, and then the hangover began

Yeah, that's how it works every single time, with no exceptions. And if you party for 12-18 months in a row, you can take some time to recover and be able to stand up again.

We can still see the post-party consequences: broken glasses everywhere, lots of empty bottles in everyone's cellars, people don't remember where they left their pants, or why there's a tiger in the bathroom. As usual, even the pool needs to be emptied and cleaned up. You know, it's like every post-party: you regret many things, but those crazy moments will be remembered for years. Right?

What can we expect for 2023?

Public and private markets are still a mess, and we'll need 9 to 12 months to clean up all the garbage.

Some of it is in front of us, and others are still well hidden under the carpet. But the good news is that things are returning to normal: valuations are lowering, and people are beginning to understand that you can't raise at $15M or even $25M post-money without traction, customers, and revenue.

The process will be longer than expected, and probably we'll need to wait until the next Indian Summer in Q4 2023 to be able to smile again. The incredible thing about startups is that, even in this deep crisis, new ideas come to life, and people never stop experimenting. We are all blown away by generative AI capabilities, and I see much potential in fields like education, mental support, and AI-aided content creation. Markets like security, cloud management, developer, and API-first tools — among others — might be a safer harbor if they raised and spent wisely in the last couple of years. 2021 newborn unicorns will need at least three years of cash in the bank to sustain the valuation of the past and avoid down rounds.

AI will be the buzzword of the year, but in this field, we are just at the beginning, and we have at least five more years—someone says twenty—to perfect those technologies. And in the meantime, the more they become valuable, the more regulators step in. We know regulation is an unfortunate necessity—as Paul Graham once said in a tweet—and AI will be first in line once it gets ready for mass adoption.

Read more

Predictions by a16z

Predictions by Frank Rotman, Founding Partner at QED Investors

Predictions by Tomasz Tunguz, former Managing Director at Redpoint Ventures

Fintech Predictions by GGV Capital

Climate Tech Predictions

VCs’ Predicitons on Forbes

VCs0’ Predicitons on Business Insider (paywalled article)

2023 US Venture Capital Outlook by Pitchbook

The next big thing in 2023 will be... by Nikhil Basu Trivedi