The 2023 Startup Market Trends Seen by a Partner of a Micro VC

“We don’t need more firms deploying $10B. We need lots of little venture firms deploying $100M. It results in more choice for entrepreneurs." — Fred Wilson, Partner at Union Square Ventures.

This article was initially published on Lombardstreet Ventures blog, a pre-seed and seed-stage venture capital firm I co-founded that invests in US companies—Silicon Valley and hackers first. If you want to read more about Lombardstreet Ventures' investment focus, check this Notion page and if you believe that you could be a good match, apply here.As we approach the second half of 2023, it may be helpful to consider what could happen in the world of startups. By gathering insights from analysts such as PitchBook and Crunchbase, along with my perspective as an investor in the pre-seed and seed stage high-tech startup industry, I aim to share some thoughts with the US founders and investors community. Please note that this is not a forecast or analysis, but rather a way to provide some helpful information and share Lombardstreet Ventures’ opinion.

Thought #1: Companies staying private for years, thanks to abundant capital, is a massive problem for everyone.

Raising capital on every front is brutally harder than before; we all know that. The reason for this is the current global market and fewer expected liquidity events since Q1 of 2023:

Plus, the hangover of some spectacular failures—and frauds—in the crypto space contributed to undermining the credibility of an entire market in less than 12 months. Blockchain and crypto are related but completely different endeavors; nonetheless, everything attached to the distributed Internet suffers these days.

2021 and partially 2022 made companies at every stage believe that the party was never-ending, which proved wrong. Everyone in the ecosystem is responsible for what happened: founders, investors — especially the bigger ones — and regulators, who allow companies to stay private for too long, raising billions of dollars without a fair check of their fundamentals with the market.

It worked much better when fast-growing companies went public after a few years. Their IPOs weren’t at $50B or $100B but at $2B, $3B, or $5B, like Netscape — $2.9B — or Apple — $1.8B. In the past two and a half years, there has been a concerning pattern among nontraditional investors, particularly crossover investors, who have invested significant amounts of capital at inflated valuations, resulting in an unbalanced venture capital market.

Their participation decreased abruptly in the last 9–12 months, but I’m sure the new wave of FOMO around AI will bring them back soon — like Masayoshi San, chairman and CEO of Softbank Group, said recently: “Now, the time has come to shift to offense mode.” I hope not, but the data says this is already happening:

According to PitchBook Q4 2021 Venture Monitor, US VC-backed companies raised nearly $330 in 2021. However, a concerning anomaly was the rate of contribution—way too high—of nontraditional investors to the funding party:

Nontraditional investors such as corporate VC funds, hedge funds, PE firms and sovereign wealth funds participated in nearly 77% of total annual deal value.

Also, multi-stage VC funds have appeared on the market more and more frequently since 2019, maybe as a response to massive nontraditional investors or maybe as part of their growth strategy. The increasing investment appetite drove an excess of capital, which made companies stay private longer, creating a surplus of expectations that would be rarely met at the IPO.

Besides, the dry powder in Q2 2023 is still high at $279.8B, even if:

$170.5 billion, or 60.9%, of this dry powder is concentrated in mega-funds — those with $500.0 million or more in commitments — many of which have slowed their dealmaking activity in response to market volatility.

News spread that the SEC may take action soon:

The Securities and Exchange Commission’s proposed regulations around private funds would mandate disclosures of vital strategic information around fundraising and force companies to prematurely go public.

— Q2 2023 PitchBook Venture Monitor

Everyone seems outraged by the SEC proposal. Well, I’m not. I don’t know if this is the best way to fix the leak, but for sure, it’s a way to start a discussion. If Microsoft decides to invest $11B in a nine-year-old company with no revenue because AI is the future, I’m OK with that—it’s part of Microsoft's strategy. At the same time, I’m not OK when an investor decides to put $300M or $1B in a private company—some of which are pension funds—without disclosing the core finances of the entire operation.

Those bets can be harmful to the entire ecosystem if not sustained by a rationale of steady revenue growth and a sustainable business. If any of these houses of cards collapse, we will suffer the consequences for years—and the venture capital is a long-term game.

Thought #2: Founders must be thoughtful about their capital-raising valuations due to the long-term effects on their company.

To create a sustainable business that can last 50 years, it’s crucial to prioritize a strategic approach during fundraising. Remember: this is a marathon, not a sprint. Setting your valuation too high can result in a quick and devastating failure, impacting not just you but also your employees, their families, and all stakeholders involved.

There are way too many unicorns in the market today, and that’s dangerous for everyone, as the PitchBook report reminds us:

Now with nearly 700 US-based companies holding unicorn status, a healthy public market exit option is near necessary.

and 2023 trends are not strong enough:

Through the first half of the year, we observed just $12.0 billion in exit value generated from an estimated 588 exit events. An immense amount of capital remains trapped in late-stage and venture-growth-stage startups hesitant to gamble on whether their financial performance can withstand the intense scrutiny of the public markets.

— Q2 2023 PitchBook Venture Monitor

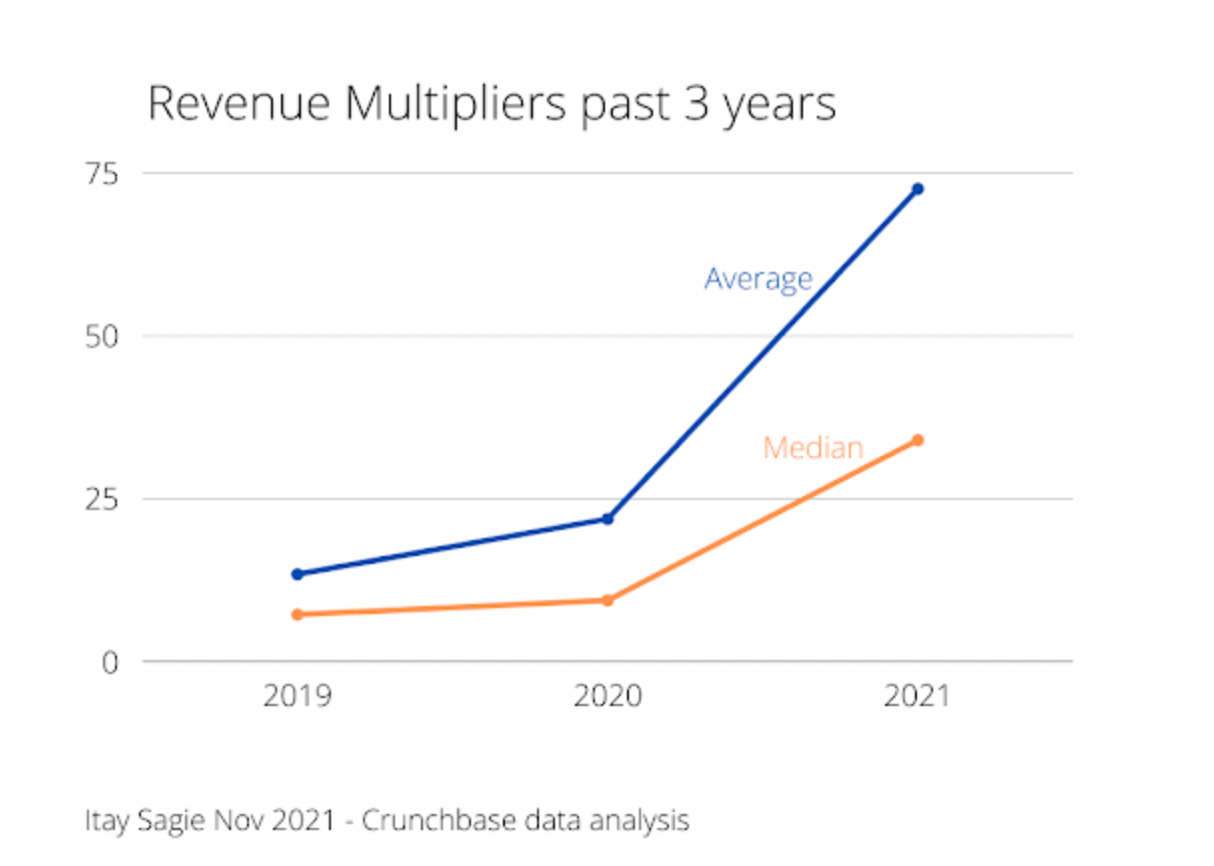

In 2020-2021 we had significant anomalies that didn’t help. In recent years, companies have been raising funds with a 100X revenue multiple. In contrast, only a few years ago, it appeared risky for businesses to go public with a revenue multiple of 10X.

Today that value is below 10, as a recent report by Crunchbase showed analyzing a sample of more than 5,400 M&A deals (USA, EU, and Israel):

The USA revenue multiple for Q2 2023 is 7.3X which is a favorable result compared to twelve months ago. Although, I guess AI companies’ contribution is significant to that number.

AI will drive a big part of the innovation in the following years, but the market is still immature despite all the enthusiasm.

Generally, when companies are so young, and valuations grow so fast, that is not a good sign.

Rewind, a startup that records and makes searchable all meetings, emails and electronic interactions, fetched a $350 million valuation from NEA, based on revenue of only $700,000, The Information reported. Other investors were also willing to assign the startup a price tag of as much as $1 billion, Rewind founder Dan Siroker told The Information.

In another example, LangChain, an AI startup with “minimal” revenue, has snagged a valuation of more than $200 million in a round led by Sequoia, Business Insider reported.

— In the world of startup valuations, there’s generative AI — and everything else

It seems like we’re back to square one. Companies that haven’t achieved Product-Market Fit yet must demonstrate that they have a product that appeals to a broad audience. While I understand why some investors follow this approach, I don’t think it’s the best course of action for us right now.

Although we may be entering a new era, seed-stage companies are still in their early phases of development. Therefore, valuations between $5M and $20M represent a significant leap of faith in their potential accomplishments.

Thought # 3: A healthy Seed Stage financing should include only angel investors and VC funds below $100M.

Having a big name in VC backing your first round after F&F is considered a huge accomplishment, but it’s not. Raising $2M from a $500M Seed Stage fund doesn’t make you on top of their priorities. The same $2M could be from 10 or 15 different investors, each one eager to help when you need it. It’s rule #1 in fundraising. I understand those funds have scouts who typically invest $50K or $100K for the VC firm. However, these investments do not provide a genuine connection with the general partners, as they are often too busy and have limited time to spare. Their attention is primarily focused on the 10–12 companies where they hold a board seat.

TL;DR: the fund size defines the stage at which the VC firm is meant to invest.

When a piece of news hits TechCrunch about a tier-1 VC closing a Seed Stage fund of hundreds of millions, you should ask what’s their strategy. What are their aiming to invest in? How can they deploy $500M across 20-30 companies?

Maybe a $5M check and $10M for follow-on/pro-rata rights? Or maybe, they look for those expensive companies everyone wants to invest money in. Or they say Seed, but it’s more from Pre-Series A to Series B. In my experience since 2017, I have not seen any of those company’s partners attending a YC, a TechStars, or a 500 Global demo day—if not with scouting checks.

In any case, a Seed round should have more than enough with a $2M raise. I specifically refer to software companies, as other industries may have varying requirements. However, it is important to note that raising excessive funds too early is never a good idea—especially if you are a first-time founder.

What’s the sentiment at Pre-Seed and Seed? The deal value for US startups keeps decreasing QoQ while the median valuation at the Pre-Seed and Seed stage levers up:

Also, the median deal size is going up:

Contrary to market pressures, the median seed deal size continued a YoY growth trajectory, climbing to $2.9 million in 2023 YTD

My Conclusion

There’s more selection at the deal flow level, and the FOMO effect is almost uniquely confined to some AI opportunities. On the other hand, the US economy is growing, with S&P at +16% in the past six months, which means that the startup market may recover somewhere next year. For now, I recommend that all entrepreneurs stick by the guidelines outlined in a recent Crunchbase article 😉:

Companies that prioritize execution and strike a balance between growth and profitability — with an emphasis on the latter — are poised to weather this storm successfully.

If you want to read the whole PitchBook report, the source for most of this data, you can find it here.